In light of the events of the past few months, the tax season looks a little different this year. With federal taxes not due officially until July 15, many states followed suit and pushed the deadline for filing back as well. That said, many business owners beyond this particular deadline are opting to file a six-month extension as they ease back into business as usual. As you prepare your business taxes, whether for July or for the extended filing date, it's important to be aware of all relevant deductions, as this can certainly save you money in the long run. Below are some of the more significant deductions you should definitely be aware of.

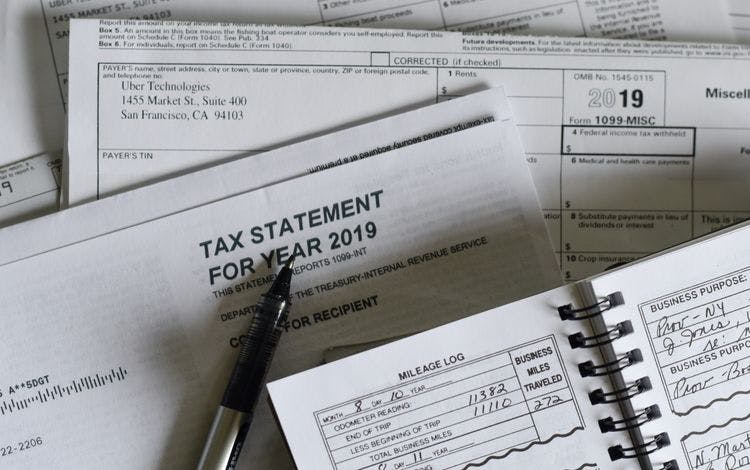

1. Cars and Mileage. Pretty much almost all small businesses utilize a vehicle in some capacity. You can thus deduct the cost of having the vehicle as pertains to business needs only. Or you can also go with the IRS mileage rate of .58 per mile (2019/). Keep in mind, you need to have a record of mileage traveled, and again, it must be for business reasons only as far as deductions go.

2. Wages Paid. Any payments that you make to employees to include salary, wages, bonuses, and commissions, can be deducted by the business. That said, you cannot however deduct payments made to sole proprietors or partners as they are not considered employees.

3. Outsourced/Contract Labor. The freelance sector is growing rapidly. This means that more and more small business owners are in fact outsourcing certain tasks and projects to contract workers. The cost of this type of labor is deductible. You do have to issue 1099 to any contract work that you pay more than $600 to in a given year.

4. Supplies. Essentially anything that is used by the business for the business by way of supplies can be deducted. Even things such as postage for business mailings as well as cleaning items used within the office are considered deductible expenses. This is why it is important to keep a close record of what you do buy for business versus that which you purchase for personal use.

5. Rent. If you rent a space for your business then you can deduct the full amount that you pay in rent each month. This can be an office, storefront, warehouse, factory—again as long as the business is conducted within the space then this can be written off on your taxes.

6. Utilities. Obviously, the electric, gas, water that you pay for within your office/workplace are all deductible. That said, some people don't realize that they can also include mobile phone costs and Wi-Fi, as well as trash removal if applicable.

7. Insurance. With most of the insurance policies that you have in place, the premiums are all deductible; so for instance, business owner's policy, flood insurance, cyber liability, business continuation insurance, and any other relevant policies you may currently have. When it comes to health insurance for yourself and employees that work a bit differently. You can potentially qualify to claim a credit for 50% of premiums paid for employees. For self-employed people, the cost of health coverage cannot be deducted from the business taxes, rather the premiums are deducted on personal returns.

8. Property Repairs. Things do need to be repaired at times and also maintained. The costs of any repairs that you do put into the business owned property are fully deductible. Again, it is important to keep detailed records regarding what you have donerepaired to your property.

9. Commissions. Generally speaking, commissions paid are deductible. You will likely need to report this on Form 1099-MISC. If however the commission was paid in the process of buying real estate this would not be considered a deducible expense.

10. Travel. Travel deductions are a bit more involved than some of the others. If you or your employees do have to travel for work-related matters you can deduct some of the expenses. Transportation and lodging are fully deductible expenses, so for example hotel cost and airfare. However, the way in which you can deduct food/entertainment and the like are not so cut and dry. The IRS website goes into greater detail in terms of what is allowable in this context. Be sure to always keep records of any expenses incurred while traveling for business.

11. Advertising/Marketing. These are obviously a big part of running your business. And some companies do spend a fair amount to advertise and market their brand. That said, most expenses attached to advertising are fully deductible. From costs related to your website and online presence to any brochures and pamphlets, you may have produced, to those costs incurred as a result of trade shows you might have attended.

12. Home office expenses. If you primarily work out of your home, you can then deduct part of your homepersonal expenses under the home office deduction. You can deduct for instance a percentage of your rent/mortgage based upon the square footage that you actually utilize for business purposes. You may also to this same extent deduct a portion of real estate taxes paid. Percentages of utilities are also allowable here. And if you have specific work done to the office portion of your home, for instance, painting that office, this too can be written off.

13. Legal fees. Legal fees can be deducted if such are relevant to the business. So you may deduct for example the cost for contract review. You can also deduct fees paid out for other professional services such as accounting for instance.

First Union Lending has been helping small businesses across the country. Our loan programs are fast and flexible—some receive cash in as little as two business days. Offering short term loans, lines of credit and business credit cards, among other such products, we have something to suit just about any company's needs. Call today and let's get started together!