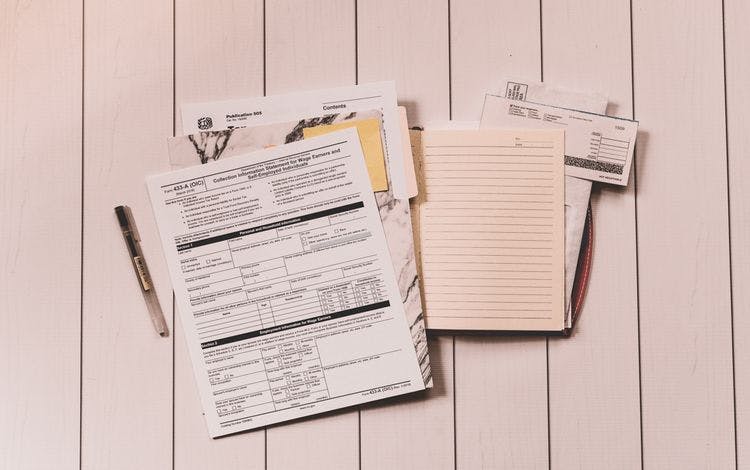

Come tax time, many small business owners dread the process involved with the preparation of their income taxes. From calculating profit and loss to understanding what expenses can be written off, it can be a bit mind-boggling at times. We've thus put together a brief guide for sole proprietors filing a Schedule C with their Form 1040. Hopefully, this helps put into some perspective that is involved with your small business tax preparation.

When Are My Taxes Due?

Most often a small business owner will file their business returns in tandem with their personal. That said, the due date for your taxes will be that of the personal tax filing due date: April 15th. If the 15th is a weekend or federal holiday, then it will be due on the next business day.

Should I Have an Accountant Do My Taxes?

If your company finances are fairly cut and dry, then handling your tax preparation should be relatively simple. You could simply use tax prep software. However, the smart move is almost always to hire someone who is well versed in income tax preparation. Laws and regulations change yearly; a skilled tax preparer or accountant is on top of the latest updates to the tax code and can thus guide you accordingly.

Schedule C

As a sole proprietor or also a single-member LLC you are going to need the following forms to complete your taxes:

- Schedule C

- Instructions for Schedule C

- Schedule SE (self-employment tax/)

- Schedule SE instructions

To properly fill in all requisite information for Schedule C, you will need to be able to provide the following:

- If the company has inventory or parts, you have to gather pertinent information to arrive at the costs of goods sold.

- Your allowed tax deductions; so this may include: travel expenses, meals, costs associated with driving, etc.

- The information about any assets that you acquired for the business itself: vehicles, equipment, technology; you will also need to calculate depreciation costs.

- If you work out of the house, you may be eligible for certain home space deductions.

Self-Employment Taxes

If you own your own small business you're likely going to have to pay self-employment tax—social security and Medicare taxes. Generally speaking, this can be a bit complex and so hiring a certified tax preparer is a good idea when it comes to calculating self-employment tax. You could also use Schedule SE or tax software.

Adding Schedule C to Your Personal Return

Once you arrive at the net income for your small business (line 31/) you will then add this to your return (line 12/). The adjusted gross income section is for additional tax credits or further business-related adjustments. The adjusted gross income will also show half of your self-employment liability. The total self-employment tax goes on line 57.

How to File Schedule C

You can either mail it in, or you also have the option to e-file your taxes. The IRS provides instructions for both, along with mailing addresses based upon where you live.

Getting an Extension

Sometimes you simply aren't prepared come April 15th; in this case, you might look into filing an extension for your taxes. The extension will allow you to wait until October 15th of that year to file. In certain instances, additional fees can be applied as far as getting an extension to file. You will want to check with your tax preparer to see exactly what is required and what you must do in the event of an extension.

Amending a Tax Return

If for some reason you entered incorrect information or otherwise made a mistake on your tax return, you will have to go ahead and file an amended return. Generally, depending on business type, this will be Form 1040X-Amended Return.

Paying Estimated Taxes

As a small business owner, you may not make a salary. In this case, you have to pay estimated taxes throughout the year. These are paid quarterly: April 15, June 15, September 15 and January 15. If you haven't paid enough estimated taxes to come filing time, you will have to pay additional taxes at this time

First Union Lending works with small businesses in numerous ways. Our comprehensive and flexible business loan programs—from short term loans to merchant cash advances, to equipment financing—are designed to help you grow and succeed. And with resources ranging from 5k to 10 million, we can get your cash fast. Call today to see how we can help you!