Just about every business will generate certain types of financial statements. And most often they will create four common statements: A Balance Sheet, an Income Statement, Cash Flow Statement as well as Shareholder's Equity Statement. Taken together and compared against statements from previous years, these financial documents help paint a clearer picture of the company's overall financial health. These can be generated monthly, quarterly, and also annually. The more information you have regarding your finances from period to period, the easier it will be to make decisions moving forward in terms of what might be feasible and what projects might have to wait. In this article, we look at examples of the four different types of financial statements.

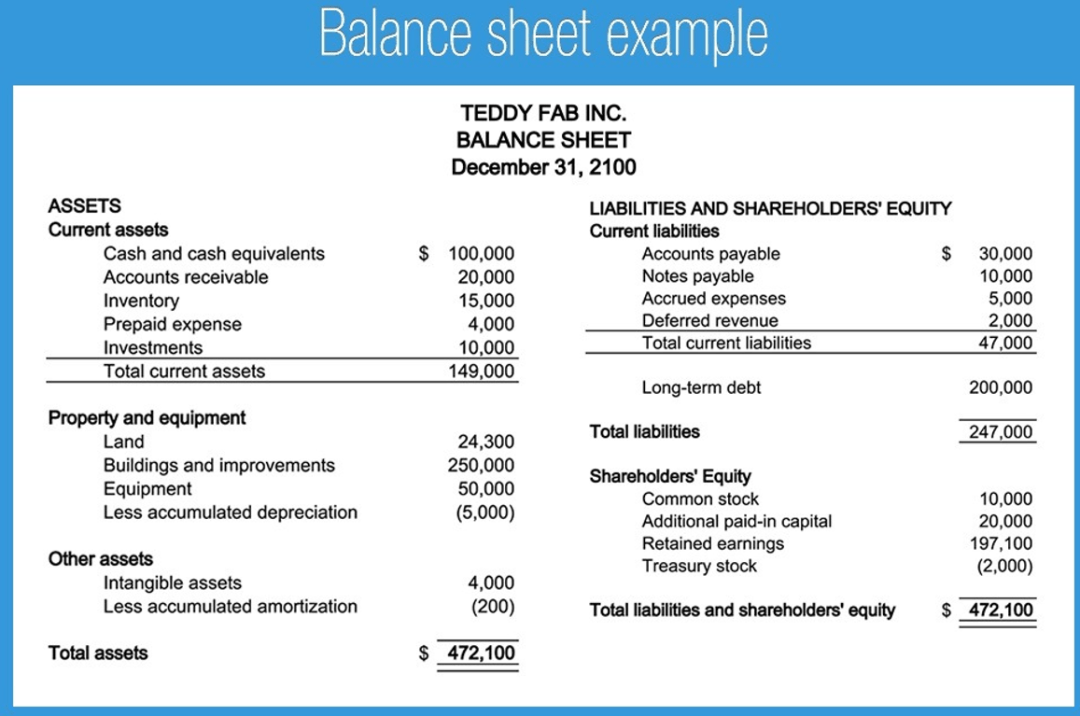

The Balance Sheet

The primary purpose of the balance sheet is to show where the company's assets and liabilities stand—both current and also long term. It also provides a snapshot of the owner's/shareholder's equity. There are times when companies may do a shareholder's equity statement as a stand-alone statement, but it is always included as the final section of the balance sheet. As far as the main formula associated with a balance sheet, it looks like this:

Assets = Liabilities + Owner's Equity

Below is an example of a sample balance sheet:

Current assets will account for that which is most liquid first, so of course, cash, followed by accounts receivable. Inventory will also factor into current assets as will prepaid expenses, so things such as rent paid in advance or insurance premiums for instance. Long term assets are going to be those items that are less liquid, to include real estate and equipment.

When it comes to liabilities, these are also going to be divided into the current and long term. Long-term liabilities are those debts that are to be paid back over multiple years. And then finally, the balance sheet shows the owner's equity--that which is left over after liabilities are deducted from assets, to include retained earnings and owner investment. The goal is to ensure that when all is said and done, assets equal liabilities plus owner equity.

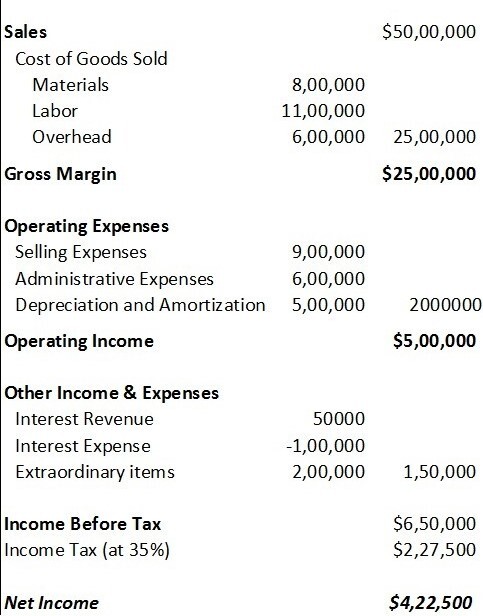

The Income Statement

After the balance sheet, perhaps the most necessary financial statement is the income statement. This particular statement focuses on revenues and expenses. It is also sometimes referred to as a profit and loss statement.

This is a sample of what an income statement generally looks like:

The income statement starts with total sales—this is net sales so before deducting any expenses other than returns or discounts. From that point, you need to deduct those expenses directly associated with manufacturing/selling the product. This is called the costs of goods sold and can include such items as material and labor. This will then show you the gross profit. From gross profit, operating expenses get subtracted. Operating expenses can include administrative costs, marketing expenses, along with other such factors. Additionally, we now need to account for any other income that comes in as well as additional expenses that may not have been figured in. This will then show you income before taxes. Of course, you do have to deduct for taxes paid and ultimately, you arrive at the business's net income.

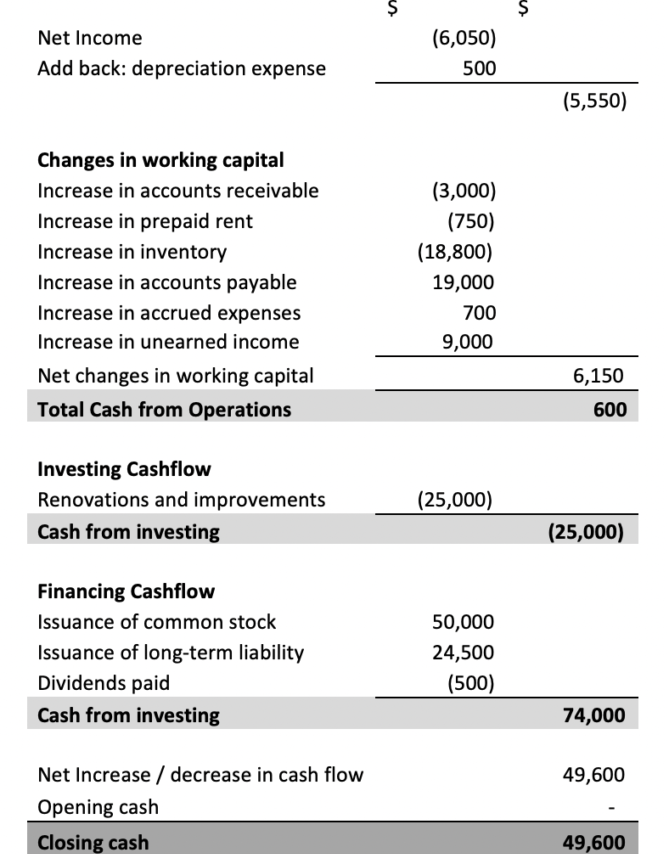

The Cash Flow Statement

Investors and creditors do look at all statements, but they pay particular attention to the cash flow statement. Especially for creditors, this statement demonstrates whether or not a company will be able to repay a loan. Below is what a cash flow statement might look like:

This particular statement will generally show different types of cash flow, such that comes as a result of operating activities and also as a result of investing as well as financing activities. As would be expected, the cash flow from operating activities refers to the money brought in as well as money paid out with the business's primary activities. Financing activities will include that which comes in/goes out relating to debt and/or equity. And then investing cash flow is that which comes in or goes out because of investments that the company makes such as property purchases.

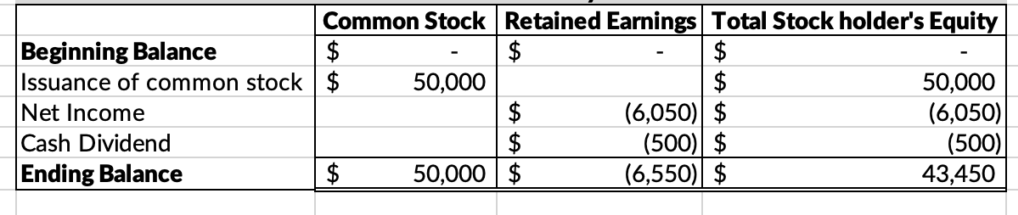

The Statement of Shareholders Equity

While not always prepared as a stand-alone statement (it appears on the balance sheet/), the statement of Shareholder's Equity can be an incredibly useful document to distribute to investors and stockholders. This will show any changes in shareholder equity during a specific reporting period. Below is a sample of the Shareholder's Equity Statement:

The components of this statement include the beginning balance by way of retained earnings from the previous period (if there were any, if not you would start with zero/). You would then record that period's net income (or net loss as it were/). If the owner takes money and thus pays him/herself this would also be accounted for—in the above example, it is listed out as a cash dividend. The ending balance thus represents the total owner equity during that reporting period.

Financial statements are hugely important for any company. The key is to keep them up to date and to compare them against one another; in this way, you can pick up on any discrepancies or inaccuracies. Again, these are particularly useful for lenders and investors, as well as any potential investors. Those looking to invest in a company generally want to be sure that the company is financially healthy, that the firm has a track record of making a profit and that the stock value is increasing. A lender, on the other hand, is looking at the ability of a business to repay a loan based upon the overall financial picture presented.

First Union Lending helps small business owners get the cash they need when they need it—not weeks or months from now. Some of our clients have the cash in their accounts within just a couple of days. We do work that fast! If you need additional capital for any reason, we would love to talk to you. Call today!