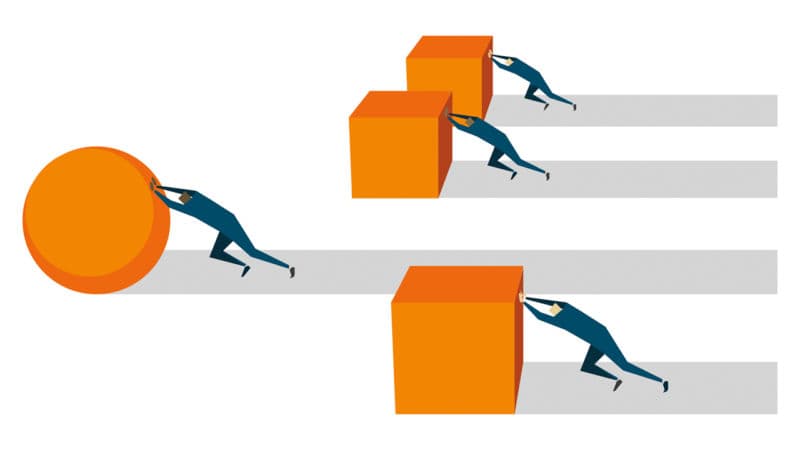

Being a business owner is like being a race car driver and if you aren’t constantly looking for ways to stay ahead of the pack, you are being left behind.

While racing a car requires an entire team, the driver is the one out on the hot track steering the car and it’s ultimately up to the driver to win the race. There are many different ways to get out ahead but one of the most reliable ways is to make sure the car is performing perfectly.

Like that car, your business must be performing perfectly if you plan on getting out ahead of the pack and staying there. Let’s look at some ways you can help your business perform better.

- Improved customer visibility. One of your top priorities should be getting seen by the people likely to buy your service or product. A small business that doesn’t have the budget of the big companies should be taking advantage of every way possible to put your business out in front of as many people as possible. There are many ways available to do this; most you can do without having to spend any additional money, just some time. Business cards everywhere you go, social networks, talking about your business, these are just some ways you can let people know about your business.

- Superior Time Management. There are only so many hours in the day and while we hear of superhumans who live off of 2 hours of sleep per night, most of us are from the planet earth and were born to normal parents. Automating some of the businesses processes can help save some time and add a few more minutes to your day. Some things that can be automated rather easily with automation that are available to you right now, like your social media posts, emails and such can shave some all too important minutes from your daily schedule.

- Efficient sales pipeline. Reviewing and revising your sales pipeline and technique regularly can add more time to the day as well as add more contacts to your sales team and revenue to the bottom line.

- Be well capitalized. The number one reason that businesses in this country fail is undercapitalization. Business owners often grossly underestimate the amount of money it will take to get their business out of the start-up phase.

At First Union, we understand that cash is the lifeblood of any business and are here to provide that cash, especially when businesses find it hard to get loans elsewhere. Nowadays there are too many reasons why banks will decline businesses for loans. At First Union we look for reasons to approve business loans, still, in the start-up phase, low personal or business credit score is ok, we can still fund. Contact us now and get the best terms.