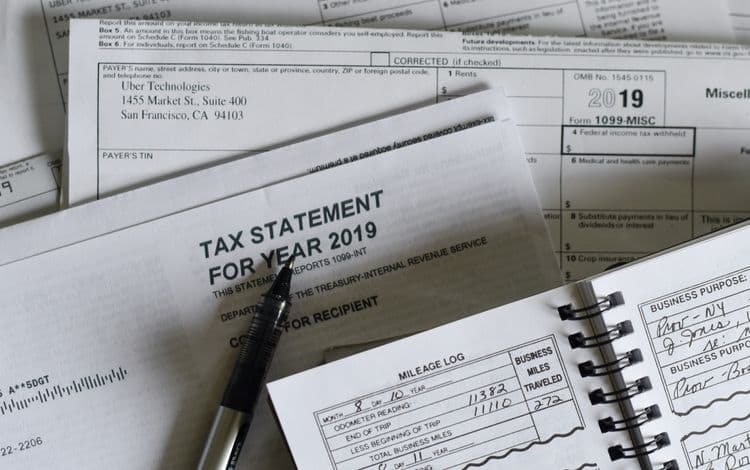

If for whatever reason you have yet to file your 2019 taxes, you don't have to panic quite yet. The deadline has been pushed back in light of the events of 2020 to July 15th. That said, that date is fast approaching. It's time to put together all of your records and receipts and get those returns done. Understandably, this has been a difficult year thus far for most. And for many small business owners especially, who are now most likely thoroughly focused on just getting their business back to "normal," preparing taxes is probably one of the last things they have time for. If that is the case, you can file an extension, thereby giving you until October 15th to submit your taxes. Below are a few things to keep in mind if you decide to go ahead and file an extension…

It is better to file an extension (as the process is fairly easy/) than to rush through everything, make a critical mistake, and then subject yourself to an audit down the road. Particularly with businesses, sometimes the returns needed can get fairly complicated. Again, far wiser to give yourself the time needed to collect all relevant records and enlist the help of a certified accountant if you require one. Take your time with this process as it is after all money that we're dealing with here.

Given the events of 2020, the IRS is expecting a fair amount of people to in fact opt for an extension. And the more complex the taxes, the more likely the person/company is to file for one. By this point, most should have gotten all of the required tax forms mailed to them. There is also keep in mind still time to fund an IRA or Solo 401k. You can also add money to an HSA you might have before July 15th.

Understanding what filing an extension means

Many incorrectly assume that just because they're delaying filing this also means they get to delay any requisite tax payments owed. Unfortunately, that is not the case, even with an extension. You need to pay any taxes owed by that July 15 date, even if you are not officially filing until October 15th. If for whatever reason you cannot make this payment, you will need to set up an installment plan with the IRS. This can be done right through their website, irs.gov. There is also the option of paying your taxes via credit card. However, that said, if you are struggling to come up with the money you owe, simply placing that balance all on a credit card could be financially harmful in the long run. If though, you have a spending threshold you have to hit on a given card to qualify for certain bonuses etc…then it may make sense. Otherwise, explore other options first.

Easily File for a Tax Extension

You can do this yourself. If you are unsure or uncertain for any reason though, it may be smarter to use a professional tax preparer to help you in this situation. If you do opt to go it on your start by visiting the IRS website. You will want to access form 4868. It is free to do this filing and again, should be relatively easy for most to follow. This only applies to federal taxes remember. If you also need an extension for state taxes, you will have to visit your state's site and adhere to the requirements for an extension request.

For those who prepare their taxes, programs such as Turbo Tax for example should also offer an extension filing option. If you are currently working with such a program, then this is probably going to be the easiest way for you to get an extension; otherwise, again the form can be downloaded from the IRS site.

There are some questions that you will be required to answer in preparing your extension form. The two primary ones are estimated taxes owed, and also those already paid throughout 2019. Beyond this, the process is super simple and essentially an automatic one. The IRS doesn't make you fill in a reason for the need for an extension. All you have to do is fill the form out correctly and the extension is almost always granted. Especially given the events of this year, the IRS is expecting to grant numerous extensions. Now you will have until mid-October to work on those taxes. The smart move would be to work on it consistently, rather than waiting until the week before the 15th of October to get it done—you'll just find yourself in the same boat.

Not Filing for a Tax Extension

So what if you skip this step altogether and not file—returns or a request for an extension? This is where penalties and interest start to come into play. A late filing penalty equates to five percent per month on your unpaid taxes. It will cap at 25% of unpaid debt. If you file on time but cannot pay on time, you are facing a .5% of unpaid taxes per month fine. This keeps accruing until you get yourself caught up. It can start to be a vicious cycle if you are not careful. And ultimately it is a waste of money, money that right now you probably need to utilize in far more productive ways.

First Union Lending has been working with small businesses across the country since the crisis began. We want to see our clients make it through this and come out strong. Our lines of credit and merchant cash advances for example may be just what you need to weather this challenging time. And even if your credit score is less than stellar, we can still help! Call today and let's get started on this journey together!