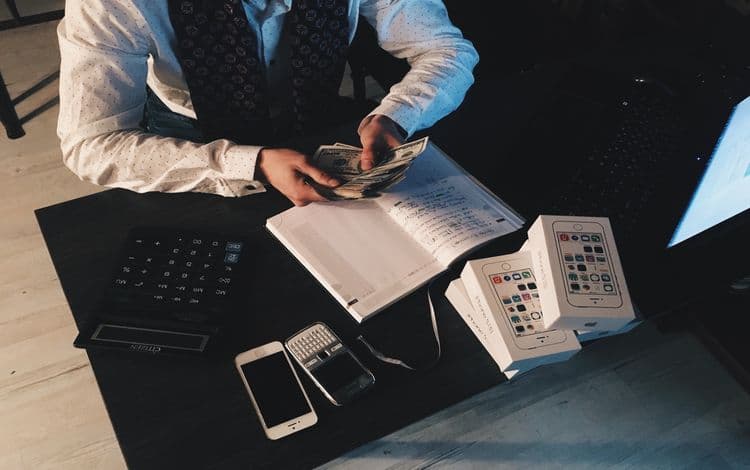

While we may not necessarily start a small business with the sole purpose of making money, it still is a fairly important part of any startup endeavor. You need to survive, pay the bills, make a living, call it what you will, but many entrepreneurs are concerned about how much they stand to make owning and operating a small business.

And certainly, it is okay to dream big. However, keep in mind that not everyone (in fact probably not many/) are going to be the next Mark Zuckerberg. That is not to say though that your small business can't take off and do quite well. You do need to understand the realities associated with entrepreneurism, especially in the beginning stages.

Early on, it is not all glitz and glamour, in fact, odds are, probably far from it. If you do stick to it, make smart decisions and plan for contingencies though, you just might make a successful go of it.

Average Small Business Owner Income: What to Expect

Consistency as far as how much you're going to make is not something a small business owner can depend upon in the early phases. In fact, your income may be quite erratic when just starting out. If you try and use national averages for a reference, there too, you really are going to be hard-pressed to gauge accurately. Industry, location and experience, all create a huge range in terms of what entrepreneurs make.

In 2017, the US average for small business owners was just under $75,000. However, keep in mind this is an average. Many make a lot less. Theoretically, the pay that business owners can expect, again depending on a variety of factors, can span the gamut from 30k all the way to 180k.

Also, remember that salary and income are two different things when you own your own business. The income is what the business itself makes over a given period of time; whereas the salary is what you as the owner can actually take home as your pay. And in the early stages of the business, this can be almost nothing. Of course, you want your business to get off the ground and move toward a profitable position. Taking a chunk of the revenue home detracts from what you can thus put back into the business.

Your employees, on the other hand, will most likely receive a salary, but with you, it's a rather different story. It is therefore up to you as the business owner to determine how much and when you pay yourself. Initially, most new business owners tend to take a very low salary to ensure the survival of the company.

Factors Which Figure into an Entrepreneur's Salary

There are going to be numerous factors which affect how much you will make as an entrepreneur. As mentioned before, big things such as industry type and where you're located in the country will certainly play into your potential pay scale. Also, some other things to consider:

- Your overhead costs

- What type of business model you have

- Any debt you may need to pay off

- Number of employees on the payroll

Again, the experience is also an important one. While the national average may be in the mid-70s, those later in life entrepreneurs tend to average around 90k. As far as the specifics of location: some things to think about…Do you get foot traffic? Are you in a high profile area? Are you somewhere where tourism is a big factor?

Understanding as much as you can about what impacts the amount of money you make will better help you control how much you personally make. In the begin, as noted, you do want to invest a lot of the revenue back into the business, but as time goes on and your business really gets going, then there is some leeway for you to make more money.

How to Calculate Your Salary

There is no single magic calculator that can tell you how much you as an entrepreneur are actually going to make. But there are steps you can take to get a better idea of what you might stand to bring in.

Monthly Net Income

You need to have a thorough handle on your company's profit margin before you can even begin to figure out your salary. This is done by calculating your net income for the month.

In the initial phase, a business usually doesn't generate enough income to pay its owners, however, it is still a good idea to keep close tabs on monthly net income. This is calculated rather simply:

Gross Revenue – Total Expenses = Net Income

Your Tax Savings and Company Debt

You can't forget the IRS when you run your own business; depending on company structure, you will probably have to pay estimated taxes. To play it safe, you should factor about 30% of your income toward taxes. Now, that is not to say that you won't be able to receive certain tax breaks—it just depends on how carefully you look for them. Hiring a professional accountant to help you out as far as potential tax breaks and deductions is a good idea for any small business.

Once you have the taxes under control, you need to look into company debt. Taking care of outstanding debt before paying yourself will be much better for the company in the long run.

Do Your Homework

Having a solid handle on your particular industry and what it entails as far as costs, taxes, income, and salaries will also enable you to gain a clearer picture of your potential salary as owner.

In the beginning, phase, consider yourself an employee—what would an average employee in your industry make? Perhaps start there. Also, weigh your experience. If you've never been a business owner before, then perhaps start on a smaller scale in terms of paying yourself.

Entrepreneur Salaries: Where You Go From Here

Okay, so perhaps the next Elon Musk you aren't…yet. You can, however, build up to a very comfortable life in which you do get to experience financial stability and all that comes with it.

Plus, think about the rewards of owning a small business in and of itself—outside what you stand to make. You have created something, you are serving customers, you are your own boss, your ideas are coming to life. And because of this, you will be able to provide a good living for your family. First Union wants to see small businesses succeed. If you are in need of funding, we can help. Call today!