Dental Practice Business Loans in South Dakota

See Your Loan Options

Only U.S.-Based Businesses are Eligible.

Dentists and their staff are known for helping their patients maintain a healthy, beautiful smile that can brighten any room. Putting trust into a dentist's office to fulfill this need requires all staff to demonstrate high efficiency, professionalism, and hard work. If you own and operate a private dental practice in South Dakota, you understand it takes a lot more than a good dentist with a steady hand to keep a practice running successfully. It comes with many challenges, whether you own a traditional dental office, an orthodontic center, or an orofacial and dental implant surgery center.

One of the more significant challenges associated with running or expanding a dental practice in South Dakota is the substantial financial expense. Many private practice owners turn to outside funding sources to finance their everyday costs in dental practice business loans.

Traditional and non-traditional lenders tend to provide various loan options to dental practices across the United States based on the industry's reputation for repaying loans on time. Dental procedures tend to generate a stable income and a strong earning potential, thus making acquiring funds from a business loan smooth.

First Union Lending has provided working capital to many South Dakota based dental practices run by passionate workers who enjoy treating their patients daily. We are ready to help small and growing dental practices attain the necessary funds when needed.

What Are South Dakota Dental Practice Business Loans?

Dental practice loans are industry-specific loans offered by traditional and non-traditional lenders to support business needs. It provides funds to small and growing practices to manage capital flow, purchase necessary equipment, run payroll, etc.

Types of Dental Practices that can obtain a business loan in South Dakota:

- General Dentist Practices

- Periodontist Practices

- Endodontic Practices

- Orthodontic Practices

- Oral Surgeon Centers

- Pediatric Dentist Practices

- And Other Dental Related Businesses

Various dental practices require working capital to operate and service their patients. The best solution for a small or growing company is to acquire the funds needed to enhance its endeavors. First Union Lending is here to help! There are a variety of loan options that can help your business thrive.

Types of Dental Practice Loans and Financing Options

Once you, the business owner, have determined the requirement for additional funds, consider the factors most important in acquiring a loan. Many factors are considered when choosing the best loans relevant to the dental industry. Business owners should apply for loans that offer low-interest rates, down payments, and collateral requirements.

Here are the more widely used loans to help businesses in the dental industry grow:

SBA Loans: Partly guaranteed by the U.S. Small Business Administration, traditional and non-traditional lenders offer SBA loans. The program provides highly flexible rates and terms ideal for small businesses. Well-established companies looking to expand their initiatives can use several variations of SBA loans.

Businesses must meet the following requirements to be eligible:

- Operate for profit

- Be considered a small business, as defined by the SBA

- Be engaged in, propose to do business in, the United States or its possessions

- Used alternative financial resources, including personal assets, before seeking financial assistance

- Not be delinquent on any existing debt obligations to the U.S. Government

These SBA loans, in particular, can benefit small but growing businesses within the dental field.

SBA 7(a) Loan: 7(a) loans are the most common within the SBA family. With access to up to $5 million in working capital for 25 years, these types are typically adequate for most industries. Interest rates are between 7-8% depending on trade and the nature of your business. Most businesses opt-in for an SBA loan fall under this 7(a) category.

SBA 504/CDC Loan: 504 loans are particular; it provides long-term, fixed-rate financing through Certified Development Companies (CDCs), SBA's community-based partners who regulate and promote economic development within their communities. If your business needs to purchase commercial real estate or perhaps a large piece of equipment, this may be the ideal loan program. The borrower may need to provide 20% of the total value, with the SBA kicking in 40% and the lender the rest. The cap on this type of loan is generally $5 million.

Businesses must meet the following requirements to be considered eligible:

- Have a tangible net worth of less than $15 million

- Have an average net income of less than $5 million after federal income taxes for two years preceding your application

Business Lines of Credit: Banks, financial institutions, and other licensed lenders often extend credit to creditworthy customers to address fluctuating cash flow needs. It is effectively a source of funds that borrowers can readily tap into at their discretion. Borrowers use this financing option rather than taking a significant, long-term business loan. When borrowers open a business line of credit, they receive access to a state amount of funds to use as needed. A monthly statement reflecting the amount of credit used will also include any interest charges, and borrowers will only pay interest on the funds used.

Most lenders will require the following basic information during the application process:

- Copy of Business License

- Tax Returns

- Three months of Bank Statements

- Standard financial documents like P&L, AR, AP, Cash Flow, etc.

Equipment Financing: Equipment loans are funding options that allow for business-related equipment purchases. Businesses will often need to purchase, replace, repair, or upgrade various equipment to serve their customers better. Companies who opt-in for this loan can buy dental patient chairs, x-ray imaging equipment, sterilization equipment, etc.

Long-Term Business Loans: This type of term business loan provides borrowers with a lump sum of funds, with a repayment plan of regular intervals of 5 to 25 years. A long-term business loan has a fixed floating interest rate and monthly or bi-monthly payments deducted from a business bank account. This financing option is best for businesses that need significant capital at a lower interest rate.

Short-Term Business Loans: Short-term loans can be highly beneficial during a growth period, fluctuating cash flow times, or a need for seasonal purchasing. It provides a lump sum upfront to a borrower and has a repayment period ranging from three months to three years. Small or medium-sized businesses can use these loans to enhance their activities.

Short-term loans have almost no limitations on their uses, and borrowers can decide how to spend the funds once they receive them within 1-2 business days. The application process requires proof of ownership of your business, financial statements, tax information, P&L statements, and a copy of your driver's license. Lenders will check your business and personal credit as well.

How to Apply for Dental Practice Business Loans: Requirements and Getting Started

If your dental practice has come to the point where funds are needed to generate a greater profit return, acquiring a small business loan may be the best option.

First Union Lending is here to help!

Submit your business information below to determine if you qualify for any available small business loans. Our Funding Specialists will analyze your qualifications and reach out to walk you through the required steps to receive funds.

See Your Loan Options

Only U.S.-Based Businesses are Eligible.

While each of the available loans has varying qualifications, lenders will typically ask for the following general information:

- Business Operations History

- Business Revenue Statements

- Personal & Business Credit Scores

- Collateral if needed

Online lenders like First Union Lending provide various businesses across the United States with the funds needed to grow and generate revenue.

If you have any questions in regards to any health industry-related business loans, feel free to give us a call: 863-825-5626

Advantages of Dental Practice Business Loans and Financing in South Dakota

Depending on the loan you qualify for, there are many benefits in partnering with a lender to gain funds for business initiatives. The funds from these financing options can solve various challenges at a dental practice.

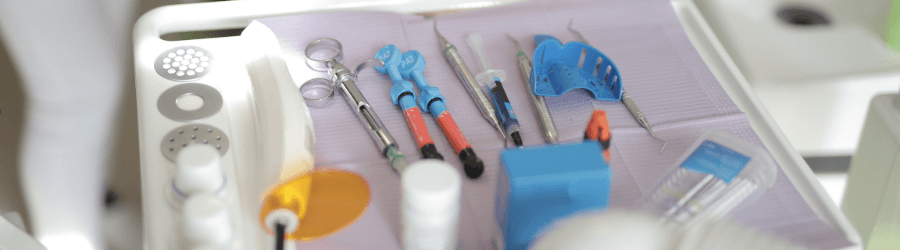

Equipment financing options can cover exam tables, dental cleaning tools, oral molds, computers, etc. These loan options provide the working capital needed for borrowers to maintain day-to-day operations. Dental practices can use this to cover payroll, make payments on equipment, or pay the monthly lease. They can also purchase or upgrade equipment.

A business loan can provide the working capital needed to upgrade your site and attract new patients to your dental practice. Businesses can use these loans to purchase an existing practice or expand. Practices looking to expand can use these funds to renovate or buy a second location. Renovating or acquiring a dental practice is costly if paying out of pocket.

Use the funds to purchase, upgrade, or enhance your business strategy. While utilizing out-of-pocket funds can be expensive, look to a lender to finance your initiatives. Businesses can use these loans to help “bridge the gap” smoothly run their dental practices.

Choose First Union Lending As Your Premier Lender

At First Union Lending, we believe that small and medium-sized businesses deserve the right to access the capital they need to succeed.

Our goal is to build long-term, lasting relationships by providing business owners with what they need when they need it. We pride ourselves on being educated, knowledgeable, and caring about conducting business. We have acquired much of the same licensing traditional banks require to cement our fiduciary responsibility to our clients and work culture.

We are here to consult, help you save, and guide you and your business to success.

See Your Loan Options

Only U.S.-Based Businesses are Eligible.

Becky: Hi! Let's find the best loan option for you