The Reason a Lender Needs to See Bank Statements

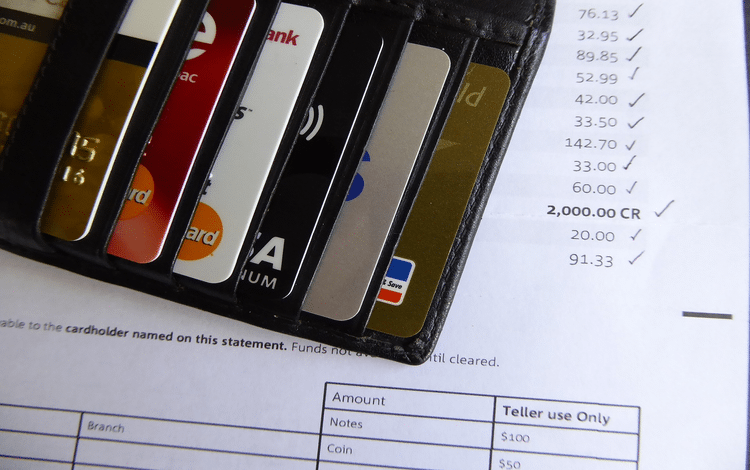

When applying for a commercial loan, one of the things that you will certainly have to submit is your bank statements. Why? Bank statements can reveal quite a bit about the state of your company and your ability to manage money. Based upon what they see when it comes to your bank statements, the lender will be able to make a more informed decision regarding whether or not to approve your application.

Yes, turning your statements over as part of the loan application packet can be nerve-wracking, however, the lender wants to get a general snapshot of the health of your small business and this is one such way in which they can do that. Your bank statements, for instance, can reveal:

- Your average balance. Too low a daily balance and this may alert them that you do not have the ability to handle another debt. Understandably, the money will be going in and out of the account, but having a sufficient amount left in there on any given day is a good indicator that your company is adept at maintaining a positive cash flow.

- Too many overdrafts. This will most definitely serve as a red flag on any loan application. Remember, the lender wants to make sure you’re not a risk, that you can pay back the loan. Numerous overdrafts and this suggests that you don’t necessarily have the ability to keep a positive balance in your account.

- How many recurring payments you have. If you have several debts that are daily, weekly or monthly withdrawn from your account, then perhaps your business may not be in the best position to take on another. Many lenders do not want to be in the “second position.” This essentially means that if the company does default the second position lender has to wait for an original creditorlender to be paid first. Obviously, not the ideal situation for any lending institution.

Remember, the lender wants to know that overall you’re in good financial health, and this will differ from lender to lender. So stay on top of your payments, manage your money by keeping a positive balance and you will only be helping yourself as far as your chances of being approved for a small business loan.

We would love to see your business grow and help you get the best funding solution your business needs. At First Union, we provide 9 different financial products to ensure that we can assist businesses at any stage of their journey. To get started, click here or call 863-825-5626 to speak with one of our lending specialists, who will help you find the right loan to make your small business dream come true.