As a Startup, There Are Many Challenges That You Will Face

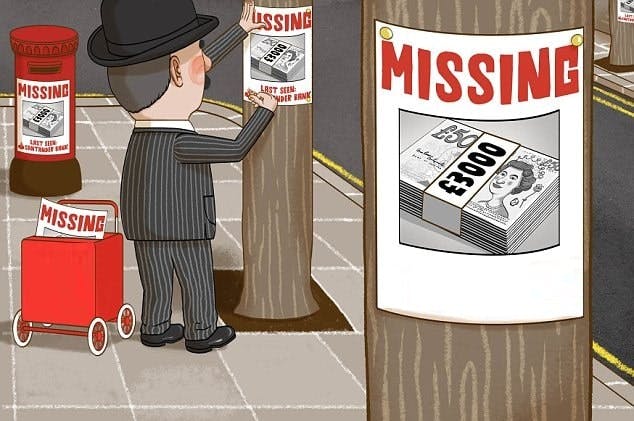

However, none of those challenges is more important or more difficult than finding the money you need to get your business off the ground. Whether it’s for your rental space, new inventory, or hiring your team, everything you do in your business will require money.

So unless you are a trust fund baby or have stumbled upon a suitcase of cash you’re probably going to end up having to work to get the funding you need. We’ve come up with a list of a few different ways to get your hands on that money for your small business.

Personal Financing

There can be nothing quite as risky or quite as rewarding and starting your own business but this risk is the precise reason why most traditional banks aren’t able to.

Grant loans to small businesses or entrepreneurs. You will find extremely difficult to get someone else to lend you the money when you haven’t put up any of the money yourself.

If you have a way to come up with the cash on your own whether it’s by refinancing your house or taking out a second mortgage these are definitely options that you should explore but be prepared to be able to live with the consequences.

At First Union, we offer many loan options from short term loans to equipment financing. Call today to find out how we can help you!