Manufacturing Equipment Loans in Pennsylvania

See Your Loan Options

Only U.S.-Based Businesses are Eligible.

Does your Pennsylvania manufacturing plant need an equipment loan to purchase the latest machines to help run your business more effectively? Many banks, credit unions, and non-traditional lenders offer specific equipment loans for companies needing manufacturing equipment. Having the most up-to-date equipment can streamline the manufacturing processes and ultimately maintain business success.

Manufacturers across the United States create everyday items that we often overlook. Many manufacturing companies in the country impact our daily lives due to their products and services. These businesses play an essential role in our overall economy.

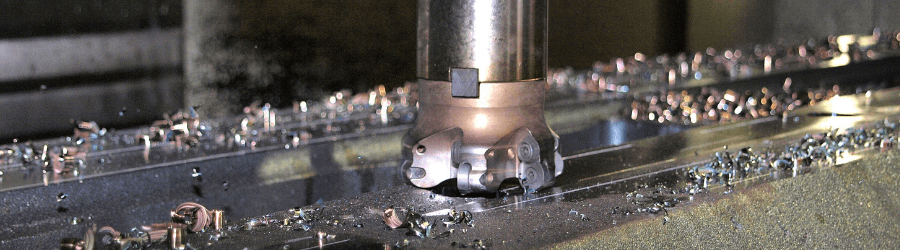

The necessary equipment is needed to help a thriving manufacturing plant create its final products for commercial use. Depending on the niche, certain businesses require cutting machines and tools, laser equipment, industrial scales, engineering software and computers, warehouse equipment, etc. For some manufacturers, their needs may vary from others - not all manufacturers are the same.

Does your manufacturing plant need an equipment loan to purchase the latest machines to help run your business more effectively? Many banks, credit unions, and non-traditional lenders offer specific equipment loans for companies needing manufacturing equipment. Having the most up-to-date equipment can streamline the manufacturing processes and ultimately maintain business success.

Non-traditional lenders like First Union Lending offer quick equipment financing and more lenient credit requirements. Equipment loan rates are around 3%, with up to $5.5 million in loan amounts

What is a Manufacturing Equipment Loan?

Manufacturing equipment loans are financing options used to buy the necessary equipment to fulfill business and project needs. Manufacturers often use these funds to purchase CNC machines, assembly system equipment, metal fabrication systems, 3D printers, industrial scales, etc.

These tools are necessary to ensure each project is completed and precise for commercial use. Manufacturing equipment loans allow small and growing companies to obtain the funds needed to keep their business running smoothly.

The Advantages of Manufacturing Equipment Loans in Pennsylvania

There are many advantages to utilizing an equipment loan. First, borrowers do not need perfect credit and business financial history to obtain one. That's generally because the equipment itself serves as collateral for your loan, enabling lenders to provide funds to slightly higher-risk clients.

Next, it's excellent for your cash flow since big equipment purchases often take a substantial bite out of your operating cash flow, putting your business in a crunch. Additionally, these loans have little paperwork (unlike SBA loans), reducing the headache and enabling you to move the process faster. Finally, most equipment loans have fixed rates, so you don't have to worry about expecting large payments to come your way.

The Disadvantages of Manufacturing Equipment Loans in Pennsylvania

There are, of course, disadvantages. Your loan term will last as long as the equipment itself does, which is likely not a quick payoff unless you repay the loan. Also, lenders won't want to extend a term past when the equipment is expected to be valuable if you default and need to liquidate your equipment. Depending on the structure of your equipment loan, lenders may require a UCC blanket lien in addition to the equipment that serves as collateral.

How Does Equipment Financing in Pennsylvania Work?

The most significant difference between equipment and other small business loans is generally the structure. Equipment loans help finance a specific type of purchase, in this case, the gear you want to buy, whereas some other small business loans are more for working capital, which you can spend flexibly.

With equipment financing, you work with a lender to secure your loan. You'll generally need to bring a quote showing how much the new or used item will cost or documentation of comparable value and utility items. Generally, loans are granted on equipment that serves as the loan's collateral. If you default, a lender will seize the equipment and liquidate it, which is why lenders often won't finance equipment that rapidly loses value.

How to Apply for Manufacturing Equipment Loans in Pennsylvania: Getting Started

If your company has come to the point where new equipment is needed to achieve project goals, acquiring an equipment loan may be the best option.

First Union Lending is ready to help finance your business!

Submit your business information below to determine if you qualify for equipment financing. Our Funding Specialist will analyze your qualifications and reach out to walk you through the required steps to receive funding.

See Your Loan Options

Only U.S.-Based Businesses are Eligible.

Online lenders like First Union Lending provide various businesses across the United States with the funds needed to grow and generate revenue.

If you have any questions in regards to any equipment financing-related loans, feel free to give us a call: 863-825-5626

Equipment Financing vs. Equipment Leasing in Pennsylvania

An essential distinction between equipment loans is equipment financing and equipment leasing. In the former, you own the equipment outright, whereas, with the latter, you're essentially renting the equipment.

In this sense, it's like a car purchase versus a car lease with one. You have the car generally long after you pay for it, although it becomes ancient. With an equipment lease, you can often choose to upgrade to a new model if you need to have a new vehicle, even if you don't have equity.

Whether you want to purchase outright or lease depends on your business situation. There are certainly pros to buying your equipment outright over leasing. First, there's equity: the equipment is yours after you stop paying for it. That's great because you don't have to worry about returning it; you can even use it as collateral for another business financing. Another significant benefit is a tax deduction: you can write off the equipment depreciation for business taxes in many cases.

There are some drawbacks to purchasing equipment over leasing, too. First, it can be a little more stressful since equipment leases generally have lower monthly loan payments and often don't require down fees. If you want to buy the equipment at the end of the lease, you may have to pay a large sum, unlike equipment financing. It is worth noting that this isn't always the case; depending on your loan, it may be cheaper over time to buy the piece outright than to pay the monthly rental payments. Additionally, if your equipment gets outdated, you can't easily swap it for newer gear since you own it outright.

Rather than spending large amounts of earned funds for your equipment, look to a lender to help finance your business initiatives.

Choose First Union Lending

At First Union Lending, we believe that small and medium-sized businesses deserve the right to access the capital they need to succeed.

Our goal is to build long-term, lasting relationships by providing business owners with what they need when needed. We pride ourselves on being educated, knowledgable, and caring about conducting business. We have acquired much of the same licensing traditional banks require to cement our fiduciary responsibility to our clients and work culture.

We are here to consult, help you save, and guide you and your business to success.

See Your Loan Options

Only U.S.-Based Businesses are Eligible.

Becky: Hi! Let's find the best loan option for you